2nd pillar / BVG (Occupational Pension Act)

Which solutions? Pension fund with full coverage or semi-autonomous pension fund

The choice of a model of pension planning is important for an entrepreneur. This choice must be carefully considered, because the stakes are high. Indeed, it represents the security of the employees’ pension.

In principle, an entrepreneur may opt for a full insurance (with a life insurer), a semi-autonomous pension fund or decide to create their own pension fund. As in any investment decision, the security/return ratio is decisive

Each business/SME has its own sensitivity, philosophy in the choice of its pension fund.

Before the economic situation had deteriorated (negative rates in Switzerland) and until the refusal to Pension Reform 2020, the full coverage offered by insurance companies and other semi-autonomous institutions was not that different. Subsequently, there has been a real change in terms of benefits, return and bonuses.

Benefits

Risk covers (disability, death) are not affected as these are defined by the needs and/or the desire of the company.

The benefits concerned are pensions for men and women, respectively retirement assets (v/returns).

In recent years, insurance companies offering full coverage have reduced the conversion rate for the “extra-mandatory” part, gradually, reaching at the moment by 2019/2020 an average of 5%. As a reminder, the mandatory part comes with a conversion rate of 6.8%.

Semi-autonomous pension funds normally offer a higher conversion rate, in principle from 6 to 6.8%, i.e. a minimum difference of 1 point on all retirement savings (wrap-around cover).

Pension Reform 2020 proposed a conversion rate for the mandatory part of 6%, based on the last actuarial bases which confirmed a rise in life expectancy as well as a growing imbalance between generations (retirement of baby boomers and decline in birth-rate).

In 2060, seniors over 65 will account for 28 percent of the population, against 17.6 percent in 2015.

Return

The stock market crash of 2000-2002 led to, among other things, the 1st revision of the BVG 2005 – 2006, 20 years after its entry into force on 1 January 1985.

In 1985, the purpose of the BVG was to maintain the lifestyle of the insured (60% of salary), taking into account the benefits provided by the AHV/IV on an average salary, defined by articles 111 et seq. of the federal constitution.

The minimum paid interest rate was 4% and the conversion rate of 7.2%.

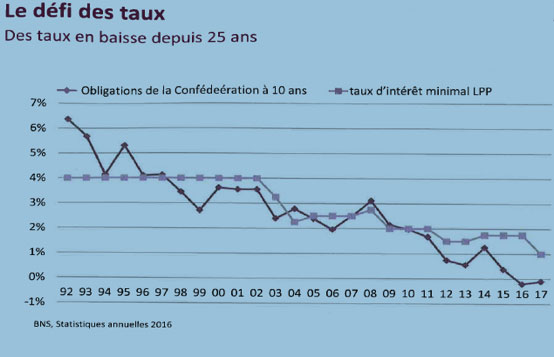

From 2003 (after the crisis), the minimum interest rate has depreciated. Each year, the Federal Council decides, in Autumn for the following year, the minimum amount guaranteed for the mandatory part. Since 1 January 2018, the interest rate is 1%.

At the moment of the entry into force of the BVG in 1985, the return on 10-year bonds of the Confederation was close to 4% and inflation was well above 3%.

Since the stock market crash of 2000-2002, the return of the Confederation’s 10-year bonds has been declining, as well as inflation, reaching even negative rates.

Since 2014, the conversion rate has increased for women (64 years old) and men (65 years old), as regards the mandatory part, to 6.8%.

During this period of crisis several insurance companies needed to recapitalise, and some have even decided to leave the market of occupational retirement pension. Others took the decision to offer an alternative solution by creating a semi-autonomous pension fund.

To date, with the obligation to guarantee 100% of the commitments to policyholders, full coverage pension funds must have a very conservative asset allocation, from 2 to 6% maximum in shares and a significant exposure on the mandatory part (60-75%). These requirements are a real challenge given the situation of the current rates.

Semi-autonomous pension funds have much more flexibility because they are not subject to the guarantee of the rate of coverage. However, in the event of coverage shortfall, there is a remediation risk which will be borne by the insured. That is why asset allocation is more dynamic, as OPP2 (Occupational Pension Ordinance) allows the exposure up to 50% in shares. Generally speaking, these pension funds have as benchmark the Pictet LPP25 or LPP40 index. (up to 25% or 40% of shares)

In 2005, the 1st revision of the BVG has the positive effect of bringing more transparency and an obligation to redistribute the 90% of surpluses, the so-called “legal quote”.

Full coverage pension funds have rarely obtained a performance superior to 4% between 2007 and 2017. In 2008, despite a particularly unfavourable economic environment, such funds were able to maintain coverage at 100%.

Each year on 1 January, insurance companies announce a temporary interest rate for the extra-mandatory part, and wait for the results at the end of the year for a possible redistribution.

For semi-autonomous pension funds, performances for the same period are much more volatile. For 2008, we see a negative performance for some up to – 11% and for others a performance beyond + 12%, with an exposure of + 30% of shares.

Coverage rates fell in 2008 below 100%, to 92% in average and for the lowest to about 88%. For many, there was no panic, as the investments of occupational pension funds are for the long term.

For the compensation to the insured, full coverage pension funds already distinguishes between the mandatory and the extra-mandatory part, and a different interest rate is being paid to the advantage of the extra-mandatory part, if the situation allows it. With other pension funds, the paid interest rate is often the same for both the mandatory and extra-mandatory part. (wrap-around cover)

To date and since 2007, if we take into account this period, the compensation paid to the insured is to the advantage of semi-autonomous pension funds, the situation being even more marked since 2013-2014.

Indeed, it is for one of these reasons that one of the major players of occupational pension schemes withdrew from full coverage on 1 January 2019, offering now only semi-autonomous solutions.

Premiums / Contributions

The cost of occupational pension schemes is mainly comprehensive of:

- Savings (retirement credits)

- Risk (disability, death)

- Fees

Savings

Of course, there is no difference between a semi-autonomous or a full coverage pension fund, since it is the employer who sets the rate of retirement credits, the minimum BVG being 7%,10%,15%,18%.

Risk

Risk premiums are to the advantage of semi-autonomous pension funds (minimum 10%) because some will reinsure all or a portion of the risk. The difference can be much more important depending on the type of activity because there is not necessarily a classification (NOGA), i.e. a difference between a company offering services or a construction company.

Fees

For the full coverage, the fees charged are more significant. For some time, insurance companies have been taking into account the guarantee, which has a cost to them since they have a need for capital underpinning. With some companies, we also see a decrease in surpluses due to too high conversion rates!

In general, semi-autonomous pension funds offer a monthly or quarterly billing in arrears.

Most full coverage pension funds offer a current account with income/expense interest.

Therefore… what solution?

It is difficult to speak for each employer because, once more, this decision is personal, related to one’s own values, doubts and certainties. What we are seeing in the market is that more and more companies are opting for solutions other than full coverage and that insurance companies offering this solution are becoming more selective in the choice of their clients.

In recent years, the persistent low interest rates, increasing redistribution at the expense of assets and the yoke that encloses investments haven’t stopped deteriorating the cost-benefit ratio of full coverage insurance for companies and their employees.

At the moment only a few companies remain, offering full coverage insurance, but for how long? The Pension Reform 2020 not having been accepted, which could have turned out to be for the best, now there is a risk of us being pushed towards far more unpleasant solutions.

We recommend that every company be advised by a professional so that they may present the market with a detailed comparison between a full coverage solution and the semi-autonomous pension funds considered.

A full coverage pension fund is subject to stricter regulations; therefore, the analysis doesn’t have to be as thoroughly conducted as for a semi-autonomous pension fund.

- In the analysis of a semi-autonomous pension fund, the following elements are important:

- Technical rate

- Coverage rate

- Generational table

- Average age

- Type of business

- Know if a company represents more than 10% of the assets under management

- Number of affiliates

- Assets under management of the pension fund (1 billion & plus)

- Asset allocation

- Reserve for fluctuations

- Number of retired people

- Conversion rate

- Performance and distribution

- Composition of the Board

- Purpose of the fund (shareholders)

- Business development

- Payment system

- Asset & Liability Analysis

If a choice or a change occurs, it must be shared between the representative of the employer and that of the employees. A session with the personnel may turn out to be very beneficial.

It would certainly be detrimental for full coverage to disappear because private insurance companies play an economic role of great importance bearing, for a large number of people, the risks that we do not wish to take; it may be, however, that everything has its price!

Glossary

Full Insurance

The main advantage of full insurance solutions is the security they offer. For insurance companies, it is accompanied by a legal obligation to annually pay the BVG retirement assets, of an amount at least equal to the minimum legal interest, whether insurers have achieved the necessary returns on the retirement assets invested on the capital markets or not. Any overdraft is impossible, as insurers must constantly guarantee 100% pension benefits. By opting for a full insurance solution, companies do not incur any risk and can devote themselves fully to the development of their business.

Semi-autonomous Solutions

These BVG solutions transfer the death and disability risk to an insurance company. The company bears the risk of investment through the semi-autonomous pension fund, and the retirement savings of the insured are placed directly on the capital markets. The investment strategy is determined by the Pension Fund Board. If the strategy plays out and allows for the generation of high returns on capital, the insured also benefit from this. If this is not the case and the pension fund incurs in losses on the invested capital in economically unfavourable years, it is however obliged to pay BVG retirement savings equal to the legal minimum interest rate. This may cause an overdraft within the Pension Fund. That is, it is unable to fully meet its current and future commitments. When this situation arises, the law allows for remediation measures (e.g. the collection of additional contributions, or the application of a lower remuneration) by the affiliated company and its policyholders – until the degree of coverage reaches 100% again.

What you should know about retirement

Asset & Liability Analysis

Analysis commissioned periodically by the pension fund, which ensures that the investment strategy (assets in the balance sheet) is consistent with the structure of the pension fund’s commitments (liabilities’ component of the balance sheet).

Retirement Assets

Assets of an insured person in relation to their pension fund. It consists of retirement credits, vested benefits, payments made on a voluntary basis, interest earned, less any capital withdrawn, whether a payment received to buy a property or as a result of divorce.

Retirement Credits

They are calculated as a percentage of the insured salary, subject to contributions, generally coordinated, and are credited on the retirement savings of an insured person.

Wrap-around pension fund

The BVG’s mandatory and extra-mandatory parts are treated equally under the law.

Degree of Coverage

Relationship between available assets and coverage capital required for the financing of benefits. A level of 100% means that the coverage is sufficient to meet all the commitments.

BVG

Abbreviation of “Berufliche Vorsorge nach dem Gesetz über die berufliche Vorsorge”, i.e. Swiss Federal Law on Occupational Benefits. The BVG came into force on 01/01/1985.

“Mandatory” BVG

The BVG established, for occupational pension schemes, the minimum provisions which must be met by each pension fund in Switzerland toward its policyholders. In addition to the regulatory savings for all policyholders, the pension funds keep an “evidence account” which displays the BVG minimum benefits. If benefits from the “evidence account” are higher than the regulatory benefits, BVG benefits are applicable. The Federal Council sets each year the BVG minimum rate for retirement savings. For 2018, it is fixed at 1 %.

“extra-mandatory” BVG

The BVG is calculated, e.g.. up to a maximum salary of CHF 84,600.- (as of 2018). Salary quotas ensured above this threshold already exceed the BVG part. The same happens with retirement credits exceeding the minimum BVG.

Fluctuation Reserve

Reserve established, or to be established, by the pension fund to compensate possible fluctuations of the investment and cover the differences of risk in relation to the benefits payable by the pension fund.

Conversion Rate

The conversion rate (also called annuity conversion rate) indicates the benefit resulting from retirement savings in a fund operating on the basis of actual contributions (the “primacy of contributions” principle). It multiplies the available retirement capital in order to give the retirement annuity.

Pension funds may use other rates for the extra-mandatory part. It comes to a “wrap-around conversion rate”, when a conversion rate is used to calculate retirement benefits resulting from the full retirement assets (that is, the mandatory part as well as the extra-mandatory part).

Minimum rate

It is fixed each year by the Federal Council and it is used by pension funds for the remuneration of retirement assets within the mandatory pension scheme, in accordance with the minimum BVG.

Technical rate

Rate applied for the remuneration of capitals used to cover the pensions.