Individual 3A/3B pension plan,

an essential complement!

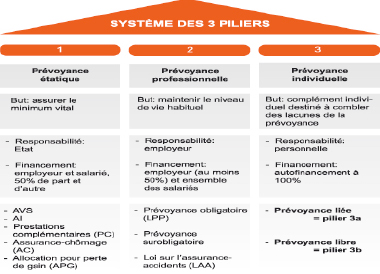

The Swiss pension system is based on the principle of the (3) pillars:

The 2020 pension reform was rejected by the people in September 2017, what happens next?

It will certainly be harder for employers and employees, because the current situation is not likely to evolve. Indeed, due to the increase in life expectancy, demographic ageing and the persistently low interest rates, the Swiss pension system is facing some serious challenges.

Therefore, personal pension plans are becoming an essential complement.

How to choose?

Each situation and life path comes with its different needs and motivations.

Firstly, entry into the world of employment, the first work contract and the first pay.

Afterwards, maybe a desire to create a family, thinking about getting married, dreaming of one’s own house… During this time, concerns are often more focused on the education of children, their schooling and the protection of the family. Then children grow and prepare to enter the “real world”, they will become independent, perhaps leaving the family: it is time to think about yourself, the couple, the future.

We believe that at any important moment of life, and with every major change, it is vital to assess the situation as regards one’s own pension plan. The best way is to ask for a “risk and pension analysis” in order to set your goals.

A risk and pension analysis allows you to review your welfare situation as regards:

- Earnings disability / disability

- Death

- Life (retirement)

“Financial planning” provides you with support in order to reach the global optimisation of the following points:

- Audit of your financial situation

- Anticipation or preparation of your retirement

- Choice between capital and/or annuity

- Optimisation of your taxes

- Organisation of your pension

- Estate planning

- Proposal of a personalised financial plan (diversification of assets)

- Search and selection of the best insurance products

- Advice, reorganisation, search for the best financing for your mortgage

What to choose?

Individual pension plans offer saving solutions, death and disability cover in the form of 3A and/or 3B contract. Please have a look at the table at the end of the article showing the processing and the benefits of each one.

Savings can be raised as follows:

- On an account with interest, (3A)

- With a capital guaranteed at contract expiry and surpluses which are paid depending on the investment situation (market) and /or the smooth running of the insurance company 3A/3B

- Based on more or less aggressive strategies, via 3A/3B investment funds

As you can see, there are enough opportunities to choose at best how to build up a capital for retirement or for other reasons; you can always find the one which is most suitable to your character. Indeed, we are all different as regards the perception of risk.

Other factors and goals are to be taken into account, such as:

- The amount to be invested according to one’s budget

- Investment period

- Objectives (pledge, guarantee, depreciation)

- Tax optimisation

- Forced savings

- Early retirement, pension bridging annuity

- Constitution of savings for equity to put down when buying a house

- Improvement of retirement

And much more.

For the constitution of 3A savings, it is recommended to create at least two accounts or policies, or even more, with different contract expiry dates in order to have a lighter exit tax; in addition, this allows for a certain diversification.

Death and disability risk covers can also be entered into in the form of a 3A and/or 3B contract; however, only insurance companies may propose solutions.

It is important that the proposed solution is well explained, because once more, the tax treatment of benefits is not the same. The beneficiary clauses must be well detailed.

From the analysis of your pension and your objectives, results your potential need for coverage in case of death and invalidity.

Who to choose?

In the constitution of 3A savings, two players are involved

- Banks

- Insurance companies

It is important to note that the regulatory framework is identical for both banks and insurance companies. It is governed by the Ordinance on Tax Deductibility of Contributions to Recognised Forms of Benefits Schemes (OPP3).

Banks

Banks offer accounts with a profitable rate (interest rate). Your assets may also be invested in investment funds with strategies offering a variety of risk exposure in shares, but not going beyond 50% of what is limited by OPP3.

With banks, it is possible to pay into your account at all times, depending on availability.

Insurance companies

They offer solutions with guaranteed capital, i.e. with a technical rate which today ranges from 0% to 0.5%. Such a technical rate is not imposed by the companies, but by FINMA, which is the supervising and regulating body.

There are surpluses which, according to the package chosen, are paid and guaranteed. Since the arrival of negative rates, the technical rate is certainly at its lowest, which is why insurance companies, amongst others, have become more creative in their offer.

Insurance companies also offer solutions without guarantee related to investment funds, in the same regulatory framework as those offered by banks (OPP3).

Insurers are often blamed for being less flexible than the banks; however, in recent years, they have striven to make their products more “adaptable”.

In addition, there are some guarantees given by one and not the other (VVG, Swiss law on insurance contracts) especially in the event of succession, protection in the event of bankruptcy and tied assets (see table at the end of the article).

This is why it can be also a good idea to subscribe to a 3B pension policy, because all the above guarantees are given, in addition to the tax aspect for some cantons.

For death and disability coverage, rates may be cheaper depending on the insurance company, as several factors are taken into account, such as height/weight, level of education, occupation, smoker or not, physical activity, etc. This depends on statistics specific to each company.

In most cases, it is advisable to separate savings and risk.

We strongly recommend that you refer to a pension specialist to discuss your expectations.

When they have determined your needs, they will proceed to determine the best offer able to provide you with the best solution on the market, (bank and/or insurance).

While comparing products, the advisor will have to talk about costs, guarantees, allocations of assets, regulations, terms and conditions, evolution of the cash surrender values, beneficiaries, etc. This list is not exhaustive!

It is important to know that there is no big or small budget in terms of pension planning. The earlier your planning begins, the more your account will earn through compound interest.

Table

Procedure

Optional subscription to a private customised pension plan according to analysis of needs and regular adjustments.

Essential in the absence of an occupational pension scheme

Financing

Insurance

Regular premiums, option to make additional flexible payments (depending on the product) and interruption of the payment of premiums for 4 years max.

Banks

Flexible payments of the amount of your choice.

Restrictions

Restricted retirement solution (3a pillar)

Payment limited by law

- Employees CHF 6,768 max.

- Self-employed 20% of taxable Income CHF 33,840 max.

Unrestricted retirement solution (3b pillar)

No restrictions

Duration of the contract

Restricted retirement solution (3a pillar)

- Payment maximum 5 years before regular retirement at age 59 (w). / 60 (m). Exceptions:

– departure abroad

– beginning of a self-employed activity

– purchase of residential property - Payment no later than at the age of 69 years (w) / 70 years (m) if the person is still active professionally

Unrestricted retirement solution (3b pillar)

No restrictions

Benefits of Risk

Insurance

Earning disability: annuity and release from payment of premiums (continuation of financing by the insurance)

Capital guaranteed in case of death plus potential bonus; payment to the beneficiary

Bank

Savings and interest become part of the estate.

Privileges in the field of retirement only for insurance

Security of the Capital

Insurance

The law guarantees the payment of the capital agreed by contract /capital guaranteed in case of survival (even in the case of bankruptcy proceedings against the insurance company)

Bank

Legal protection of depositors to a maximum of CHF 100,000 in case the Bank goes bankrupt. Option of additional CHF 100,000 coverage option (3a account only)

The insurance solution guarantees a 100% coverage of funds and savings goals.

Retirement benefits

Single payment in the form of capital plus potential bonus

Interest rate

Insurance

- Technical interest rate: fixed by the Federal financial market supervisory authority, FINMA

- Any bonus

Bank

Interest rate linked to the market situation

Taxes

Restricted retirement solution (3a pillar)

Banks and Insurance

- Annual premiums (limited) deductible from taxable income

- Tax-free interest and bonus

- No taxes on wealth during the term of insurance

- Capital payment levied at a reduced rate, separately from the rest of income

Unrestricted retirement solution (3b pillar)

Insurance

- Annual premiums deductible from taxable income under certain conditions (flat-rate deduction)

- Tax-free interest and bonus

- Cash surrender value of life insurance subject to wealth tax

- Exemption from payment in capital from life insurance financed by premiums

- Under certain conditions only, exemption from the payment in capital from life insurance financed by a single premium

Bank

No tax advantages

No withholding tax in life insurance

Privileges

Restricted retirement solution (3a pillar)

Inheritance, in the event of prosecutions, in case of bankruptcy and tax

Unrestricted retirement solution (3b pillar)

Inheritance, in the event of prosecutionsin case of bankruptcy (to the extent where the spouse, registered partner or the children are beneficiaries) and tax privilege

Retirement privileges only for insurances